Blog Post

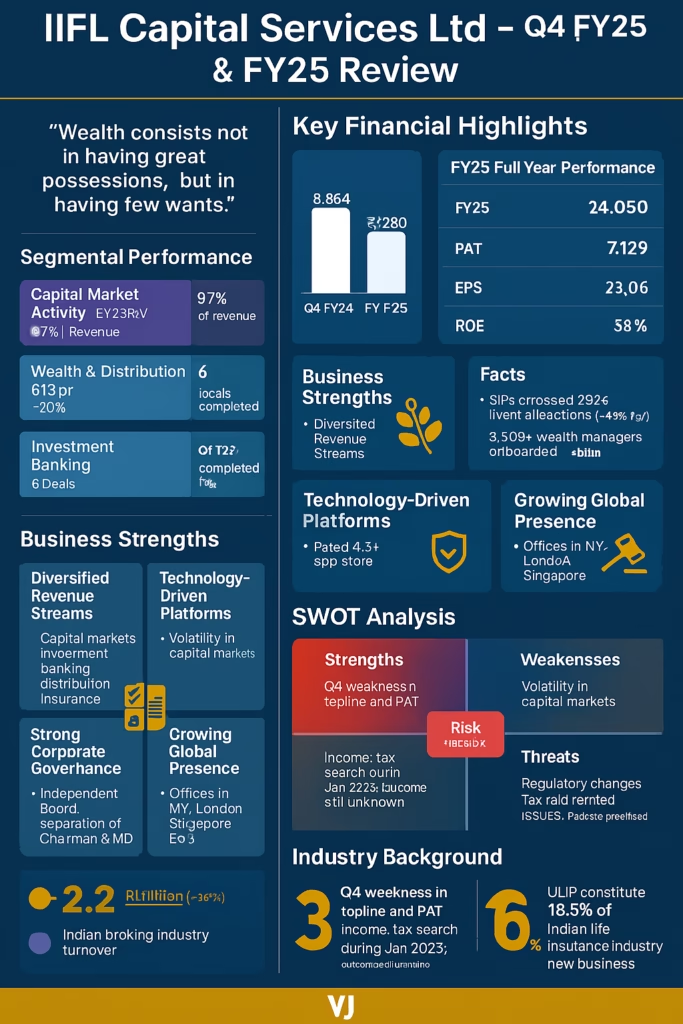

In India’s ever-evolving capital markets, few firms have managed to transform as effectively as IIFL Capital Services Ltd. What started as a traditional brokerage is now well on its way to becoming a full-service, technology-enabled capital markets powerhouse. But is it a stock worth owning? Let’s dive deep.

Eimco Elecon, a company providing minig equipment. The company is directly related to India’s growth story and playes a crucial role in to many aspects of countries self reliability. But is it also a good investment? Let’s find out..

Back on 31-Dec-2024, we flagged four major triggers set to rattle the markets: the Trump tariff saga, the national Budget, RBI policy tweaks, and the quarterly earnings roller coaster. Today, let’s dive deep into how these forces are shaping our investment landscape, and as Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.”

Pudumjee Paper Products Ltd. has long been a significant player in the specialty paper and hygiene products space. The company continues to balance innovation with operational excellence, and its latest Q3 results further underscore its robust performance and strategic initiatives.

The Indian stock market is currently navigating a challenging phase, marked by a notable downturn since its peak in late September 2024. The Nifty 50 index has declined approximately 13%, underperforming its Asian and global emerging market peers. This trend is further exemplified by the BSE Sensex, which has dropped around 7.5% since mid-December, trading at approximately 76,000—nearly 10,000 points below its September high.

he growth story of Voltamp Transformers Limited has truly caught my eye. In an era where energy infrastructure is the backbone of national development, Voltamp stands out as a key player—not just for its robust financials but also for its vision in meeting the evolving demands of a rapidly growing population and the digital revolution, where data centers for AI are set to transform industries.

EMS Limited. While it may not be a household name, this infrastructure player is making significant strides in India’s wastewater and sanitation sector. From laying sewerage networks to building water treatment plants, EMS has established itself across key states like Uttar Pradesh, Maharashtra, Bihar, Uttarakhand, Rajasthan, and now, West Bengal.

While the broader hospitality sector often struggles with inherent challenges, BHL stands out with stellar results and a notable 10% surge in share prices. As someone generally skeptical of hotel businesses, the company’s financial metrics—PAT margins of 20%+, revenue CAGR >15%, and a debt-free status—piqued my interest. Let’s dive deep into what makes this company a star performer.

The Indian equity market has been on a volatile journey, experiencing both exhilarating highs and daunting lows. Today, the Sensex took a significant dip of 1050 points (approximately 1.36%), while the Nifty followed suit with a 345-point drop (nearly 1.5%). This market turbulence has understandably left many investors feeling anxious, prompting the crucial question: What’s the best course of action now?

Quarterly earnings season is here, and investors are eagerly awaiting insights from Indian companies for the quarter ended December 2024. These results not only reflect the financial health of companies but also offer glimpses into market trends and economic conditions. Whether you’re a seasoned investor or a curious beginner, understanding how to interpret these results is crucial. Let’s dive into the key aspects you should focus on to make sense of the numbers and commentary.

While other paints artificial intelligence (AI) as a harbinger of data breaches, identity theft, and privacy invasion, I see a booming demand for data security and AI protection services. That’s where one name emerged from my analysis like a beacon: Expleo Solutions

In our last blog post, “Indian Stock Market: Panic or Patience? The Truth Behind the Volatility”, we delved into the factors fueling negative sentiments in the Indian stock market. If you haven’t read it yet, click here for a detailed analysis. As the markets remain directionless, clarity looms on the horizon. Five major events scheduled for January and February 2025 are poised to shape the trajectory of global and Indian markets. While these events individually hold significance, their combined impact on corporate earnings will ultimately determine market direction.

As India races toward its ambitious green energy goals, there’s a silent hero behind the towering wind turbines—Sanghvi Movers, a vital player driving the infrastructure for this renewable energy surge. This blog uncovers the untapped potential of Sanghvi Movers, delves into the wind energy sector’s evolution, and offers a detailed valuation analysis. With India’s wind energy capacity set to triple by 2030, could this crane rental giant be the hidden gem your portfolio needs? Find out if Sanghvi Movers is poised to soar or grounded by challenges in this in-depth exploration of India’s renewable energy renaissance!

Navigating the Indian Stock Market: What’s Going On?

Let’s talk about the Indian stock market—a real rollercoaster these days, isn’t it? One day it’s up by 1%, and the next, it’s down by the same amount. Foreign investors (FIIs) seem to be playing a guessing game, switching between selling one month and buying the next. Even domestic investors (DIIs) can’t decide—one day they’re excited about policies, and the next, they’re worried. And now, with the market about 10% down from its peak, many of us are scratching our heads: What’s going on?

What comes to mind when you think about food delivery in India? Chances are, Zomato is at the top of the list. Synonymous with innovation and reliability, Zomato has revolutionized the way Indians dine. Recently, the company hit a market capitalization of INR 294,000 crore, surpassing giants like Bajaj Auto, D’Mart, and Nestlé. But is Zomato’s meteoric rise sustainable? Can its market valuation withstand scrutiny? Let’s dive deep into Zomato’s journey, its potential, and the critical question: Is Zomato truly worth the hype?

The Efficient Market Hypothesis (EMH) posits that all publicly available information is instantly reflected in stock prices, making it nearly impossible to consistently outperform the market. But does this hold true for Mahanagar Gas Limited (MGL)?

Asian Paints, a multi-bagger stock in the past, has seen its share price decline recently, raising concerns among investors. This Asian Paints stock analysis delves into the reasons behind this downturn and explores the future prospects of this leading paint company in India.

In the ever-shifting landscape of the financial world, where market trends fluctuate and economic indicators dance, there exists a steadfast principle that has stood the test of time: intrinsic value. This fundamental concept, championed by legendary investors like Warren Buffett, offers a scientifically sound approach to investing that remains relevant, regardless of market conditions.