WELCOME to Intrinsicbull !!!

Investing in stocks means different things to different people. Some buy because the price has gone up, while others see opportunity when it has gone down. Some invest in companies with record-breaking gains, while others seek value in companies facing challenges. From market leaders to emerging players with high growth potential, every stock represents a story—one rooted in the company behind it.

At IntrinsicBull, we uncover these stories. As a famous investor once said, “A great company can be a bad investment at the wrong price, while a mediocre company can be a great investment at the right price.”

Our analysis combines insights from the past, present, and future—examining where a company has been, where it stands, and where it could go. With this holistic approach, we empower you to assess your risk appetite and discover the true value behind every stock price.

“Price is what you pay; value is what you get.” Join us on an exciting journey to uncover the stories companies are telling and determine if the price aligns with the potential. Explore our latest insights and discover the hidden truths – click HERE to dive into our blog!

Back on 31-Dec-2024, we flagged four major triggers set to rattle the markets: the Trump tariff saga, the national Budget, RBI policy tweaks, and the quarterly earnings roller coaster. Today, let’s dive deep into how these forces are shaping our investment landscape, and as Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.”

By Intrinsicbull Dated 31-03-2025

By Intrinsicbull Dated 30-04-2025

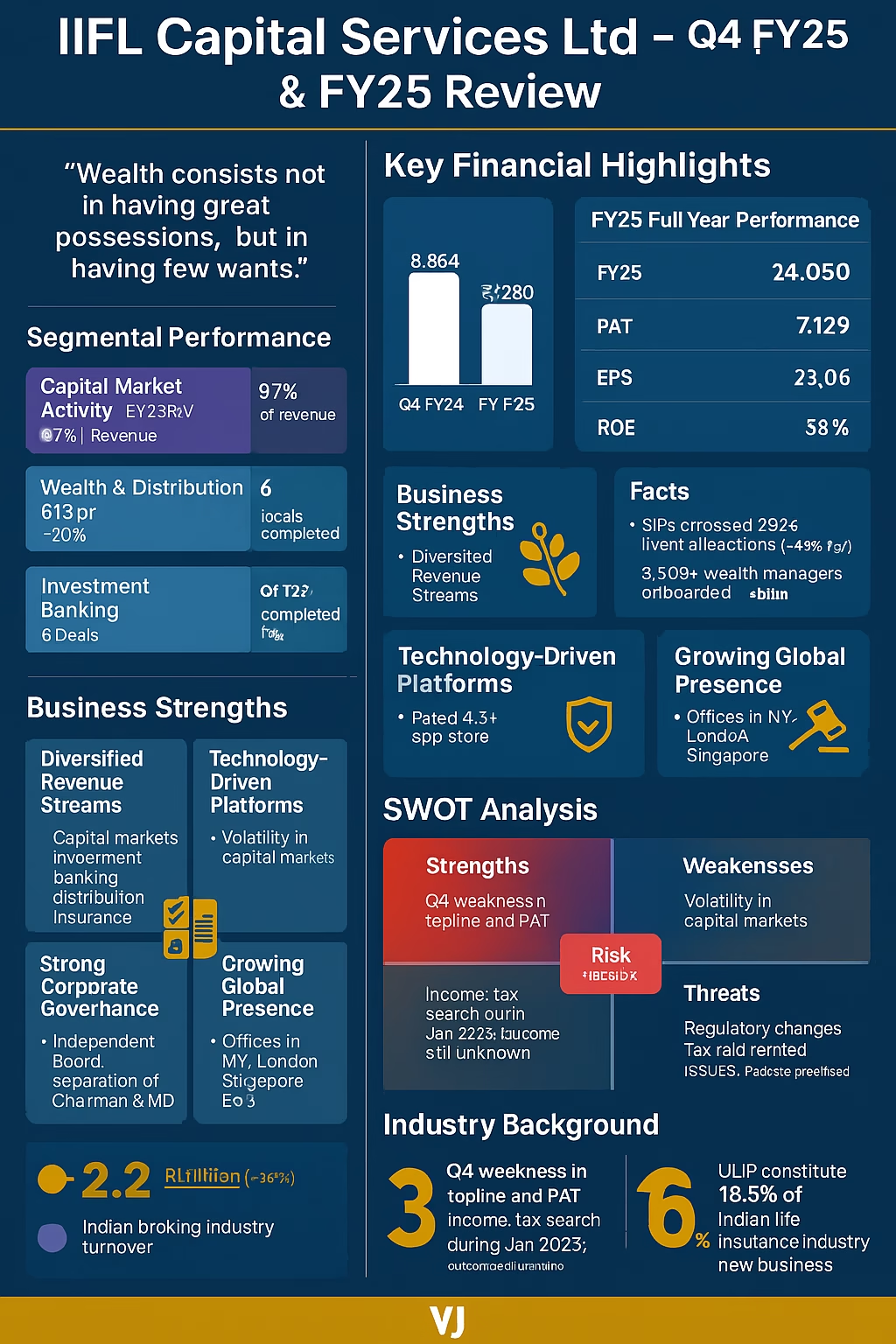

In India’s ever-evolving capital markets, few firms have managed to transform as effectively as IIFL Capital Services Ltd. What started as a traditional brokerage is now well on its way to becoming a full-service, technology-enabled capital markets powerhouse. But is it a stock worth owning? Let’s dive deep.

By Intrinsicbull Dated 02-05-2025